What to Know About Your 1098T

You'll need this tax form to report the tuition you paid when you file your taxes each year.

What is a 1098-T?

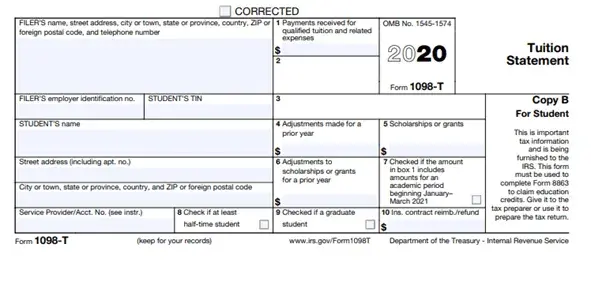

Form 1098-T is an IRS tax document that is used to report qualified tuition and related expenses paid in a given tax year.

When will I receive my 1098-T?

Current students can receive their IRS Form 1098-T electronically (printable PDF).

You must complete the steps below to receive your 2023 tax form electronically.

If consent was given to receive the form electronically, the 1098-T will be available on Feb. 1, 2024, via your account on my.flagler.edu, under the Financial Document Center.

Please note that if a document does not appear in your Financial Document Center on Feb. 1, 2024, you were not eligible to receive a 1098-T in 2023.

If you did not opt-in to receive the 1098-T form electronically, your form will be mailed on Feb. 1. The arrival of your 1098-T will depend on the U.S. Postal Service and the location of your legal address on file with the College.